End-to-end Automation

Automate bank, ledger, and payment reconciliation across all flows. Eliminate Excel macros, SQL queries, and brittle scripts.

Enterprise-grade precision for daily reconciliation, monthly close, and compliance... without spreadsheets, internal scripts, or engineering dependency.

Before Rexi

Most fintechs start reconciliation in spreadsheets and internal scripts. As volumes grow, this turns into a fragile patchwork that slows teams down and increases operational risk.

Finance and FinOps teams struggle with:

Manual bank and payment reconciliation across multiple providers

Fragmented financial data with no single source of truth

Delayed closes and unreliable reporting

Heavy reliance on engineering for pipelines and fixes

Rexi replaces this with purpose-built reconciliation software for fintechs; designed to scale with complexity, not collapse under it.

“The failure of Synapse, a key embedded finance provider, left millions of dollars in client funds unaccounted for across multiple sponsor banks and platforms.” — Wall Street Journal

This triggered Federal Investigations, Senate hearings, and a renewed push from regulators like the FDIC to demand daily reconciliation across fintech systems.

Why Rexi

Automate bank, ledger, and payment reconciliation across all flows. Eliminate Excel macros, SQL queries, and brittle scripts.

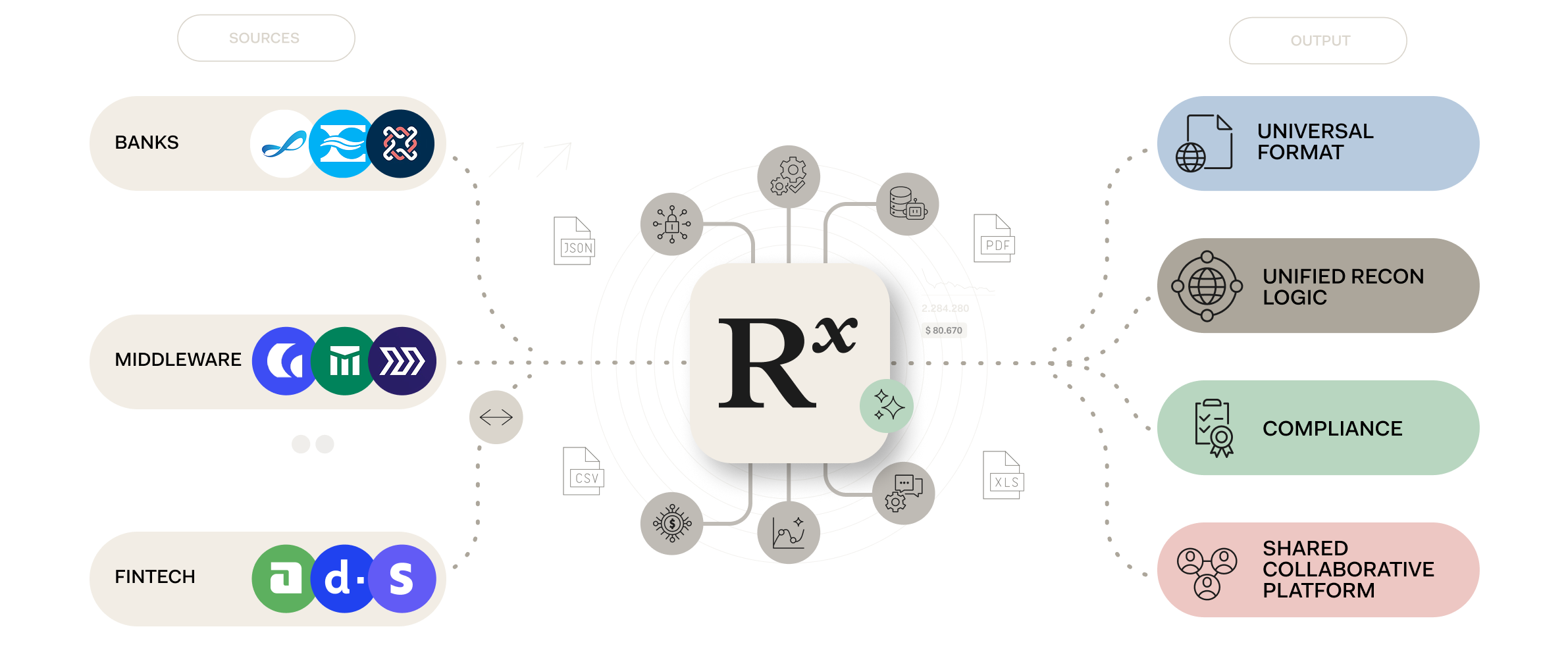

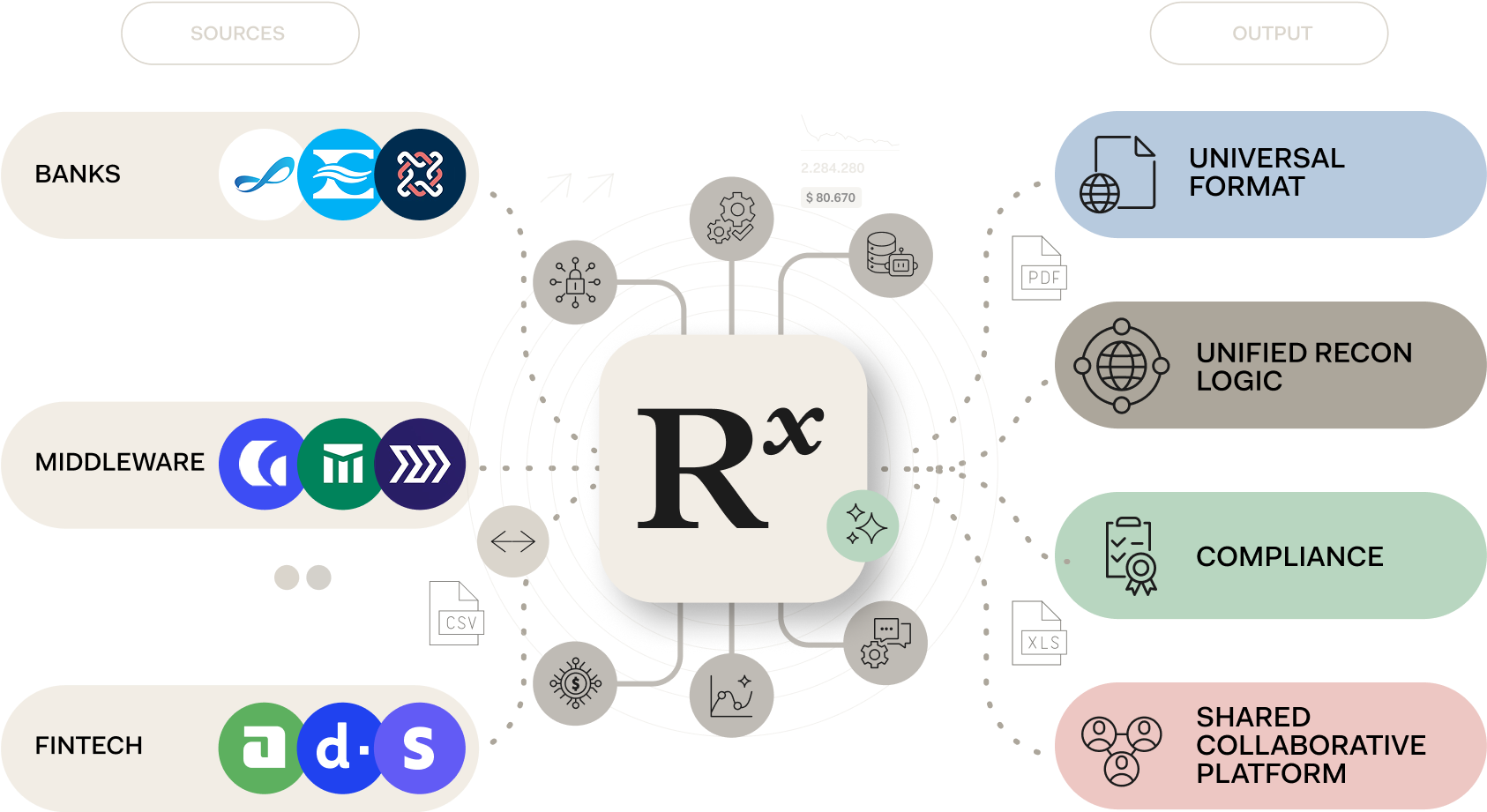

Transactional data scattered across multiple systems is centralized, normalized, and processed on a single source of truth.

FinOps teams configure and manage reconciliation logic themselves. Engineering goes back to building product.

How Rexi Works

Tailored for operational efficiency and scale.

Built for compliance-grade control and transparency.

Case Studies

Case Study

Case Study

About Us

Our Engineering team is based in Latin America, where undiscovered talent resides.

Our Product & GTM team is based in New York, where most of our customers reside.

Our Company is building the future of FinOps, where tech disruption resides.

Deep experience working with leading fintechs, AI startups, and enterprise platforms across Latin America and the U.S., helping scale high-impact digital products.

Backed and validated by world-class accelerators, venture partners, and pitch competitions across top U.S. institutions. Early traction confirms product-market fit.

The current regulatory and banking environment highlights an urgent need for reliable reconciliation tools. We’re building the infrastructure the industry now demands.

Resources

Reconciliation is a silent killer. You only notice it when numbers break, money disappears, and the truth becomes clear: no one has the full picture.

Read More

The tech stack has evolved into an increasingly modular system. Fintech companies today often assemble their products using a patchwork of specialized services.

Read More

Long seen as complex, time-consuming, and error-prone, reconciliation is being transformed by recent advances in AI and machine learning.

Read More